Filing taxes can feel intimidating, but thanks to modern technology and resources, you can easily file your taxes online from the comfort of your home. Whether you’re a first-timer or a seasoned filer, this step-by-step guide will walk you through the simplest way to file your taxes online accurately and on time.

Step 1: Check If You Need to File

Not everyone is required to file a federal tax return. Generally, if you earned above a certain threshold, have self-employment income, or qualify for refundable credits, you should file. Even if you don’t have to file, you might want to do so to claim a refund.

Step 2: Gather Your Documents

Collect all necessary paperwork before starting:

- Income documents: W-2s from employers, 1099 forms for freelance or investment income.

- Identification: Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Receipts and records: For deductions and credits, such as mortgage interest, student loan interest, tuition, charitable donations, medical expenses, childcare costs.

- Bank account details: For direct deposit of refunds.

Step 3: Choose How You’ll File Online

There are several ways to file your taxes online:

- IRS Free File: If your adjusted gross income (AGI) is $84,000 or less, you can use IRS Free File software for free.

- Direct File: Newer IRS option allowing eligible taxpayers to file directly on IRS.gov for free.

- Tax preparation software: Popular paid options like TurboTax, H&R Block, or TaxAct guide you step by step and help maximize deductions.

- Free IRS-certified volunteers: Available for seniors, disabled, or low-income taxpayers for free assistance.

Step 4: Create an Account and Start Your Return

Sign up or log in to your chosen service. You’ll be asked to provide personal information and answer questions about your filing status, dependents, and income sources. The software simplifies complex tax forms based on your answers.

Step 5: Enter Your Income Information

Input income from your W-2s, 1099s, and other sources accurately. Most software or IRS Free File partners allow you to upload or import information electronically from employers or financial institutions to reduce errors.

Step 6: Claim Deductions and Credits

Based on your financial situation, the software will help you find deductions (like mortgage interest, student loan interest) and credits (such as Earned Income Tax Credit or Child Tax Credit) to lower your tax bill or increase your refund.

Step 7: Review Your Return

Double-check the entered information for accuracy. Many platforms automatically detect errors or missing info, giving you warnings to fix problems before submission.

Step 8: Submit Your Tax Return Electronically

When ready, electronically file (e-file) your tax return to the IRS. E-filing is secure, faster, and usually processed quicker than paper returns. Be sure to save or print a copy of your filed return and confirmation.

Step 9: Choose Your Refund Delivery Method

Opt for direct deposit to get your refund faster, typically within 21 days. You can also select a paper check mailed to your address, but it takes longer.

Step 10: Pay Any Taxes Owed

If you owe taxes, pay online via the IRS website, through your tax software’s payment options, or by mail. Paying by the deadline avoids penalties and interest.

Step 11: Keep Records

Store copies of your tax returns, W-2s, 1099s, and supporting documents securely for at least three years.

Pro Tips for Filing Taxes Online

- File as early as possible to avoid last-minute stress.

- Use reputable software with security features.

- Check if you qualify for free filing options based on income.

- Request an extension if needed, but pay estimated taxes by April 15 to avoid penalties.

- Seek help from IRS-certified volunteers if your tax situation is complex.

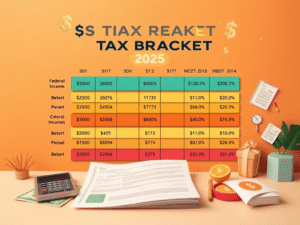

Summary Table

| Step | Action | Tip |

|---|---|---|

| 1 | Check if you need to file | Use IRS tools online to confirm obligations |

| 2 | Gather tax documents | Organize before starting |

| 3 | Choose e-filing method | Use IRS Free File if eligible |

| 4 | Create account and start filling | Answer questions honestly |

| 5 | Enter income info | Import electronically if possible |

| 6 | Claim deductions and credits | Use software suggestions |

| 7 | Review return | Fix flagged errors |

| 8 | Submit electronically | Keep confirmation receipts |

| 9 | Select refund method | Direct deposit is faster |

| 10 | Pay owed taxes | Pay by deadline to avoid penalties |

| 11 | Keep records | Store securely for at least 3 years |

Frequently Asked Questions (FAQs)

Q: Can I file my federal and state taxes online together?

A: Many tax software programs file both simultaneously. Check specific state availability.

Q: How long does it take to get a refund?

A: Typically 21 days with e-file and direct deposit; paper returns can take weeks or longer.

Q: What if I make a mistake after filing?

A: You can file an amended return using Form 1040-X to correct errors.

Q: Can I file online for free if I earn more than $84,000?

A: You can use Free File Fillable Forms or paid software options.

Call to Action

Ready to file your taxes confidently and effortlessly? Visit dollar.savewithrupee.com for detailed guides, comparisons of tax software, free IRS resources, and handy checklists to help you file your taxes online perfectly every year.

🇺🇸 Smarter Money Tips for Americans

Discover our guides on credit, loans, insurance, and savings designed for the U.S.

💡 Explore Guides